The Auction and its Bidders

Figure 1: Washington, D.C. Tax Auctions Raise Revenues Equal to Twice the Value of Overdue Tax Debt

.png)

Source: The figure shows the breakdown of revenues obtained at D.C. tax lien auctions based on the annual Buyer’s Book published by the D.C. Office of Tax and Revenue. The Buyer’s Books list information on all properties sold at auction at either the annual July tax sale or at special over the counter (OTC) sales held in 2010, 2011, 2012, 2015, 2016, and 2017. Tax debt refers to the debt the taxpayer owes as of the auction date, which includes any accumulated interest and penalties. Surplus refers to the difference between the final auction bid for the lien and the tax debt. Special OTC sales refers to the revenues earned from back taxes during the non-July special sales. The annual 2020 tax sale was suspended due to public health considerations arising from the COVID-19 pandemic. For full details see: LaPoint, Cameron (2023): “Property Tax Sales, Private Capital, and Gentrification in the U.S.,” SSRN Working Paper, No. 4219360.

The local government sends multiple warning notices imploring the homeowner to pay. If a homeowner fails to pay by the final due date, a “tax deed sale” or a “tax lien sale” occurs. The local government sells –or auctions off – the homeowner’s tax debt to investors. From the government’s perspective, auctions help recover lost tax revenue and even earn a temporary profit. In fact, as shown in Figure 1, through tax lien auctions, the local tax authority in the District of Columbia often recovers more than double the amount that the homeowner owed in unpaid property taxes, penalties, and interest.1 Put another way, for every one dollar in tax debt owed, the government collects 2.05 dollars in surplus revenues from the auctions.2

Curiously, in many states, if the winning bid at the auction exceeds the amount owed by the delinquent homeowner, it would be legally difficult for the delinquent homeowner to recoup any of the difference, sometimes also known as the excess proceeds. This legal difficulty that homeowners face in recouping the difference in some parts of the country, including the District of Columbia, has been described as “home equity theft.”3

Mechanics of Tax Lien Auctions

Tax sales often occur on an annual or semi-annual basis. An auction usually lasts between two or three days, but the length can vary depending on how many tax-delinquent properties are up for sale. In the District of Columbia, according to the website of the Office of Tax and Revenue, auctions are held in person across several weekdays in July. The exact auction proceedings vary across states. In Florida, for instance, tax lien auctions are primarily conducted online.

Potential tax-debt investors start by placing an initial deposit. This deposit places an upper limit on the potential winning bids for an investor. In the District of Columbia, the deposit must be at least 20 percent of an investor’s winning bids. For example, a DC investor who places an initial deposit of 4,000 dollars cannot have winning bids that add up to more than 20,000 dollars. The starting bid on a property is equal to the amount that a homeowner owes—in taxes, penalties, and interest. After the starting bid, bids go up by specified increments until a winning bid emerges. To obtain the lien certificate, winning bidders must pay the remaining bid amount not covered by their deposit within five days after the sale.4

Once an investor purchases the tax debt, the investor, in the words of one government notice, “may have the right to file a lawsuit to foreclose on the property.”5 The investor cannot exercise this right immediately. The tax-delinquent homeowner has a grace period of six months to pay off their outstanding debt. If that debt is not paid off during the six-month grace period, the investor can legally file to foreclose on the property. Any legal fees incurred by the investor in moving to foreclose are added to the existing debt.6 The additional debt makes it more difficult for the previous homeowner or their family members to reclaim the property.

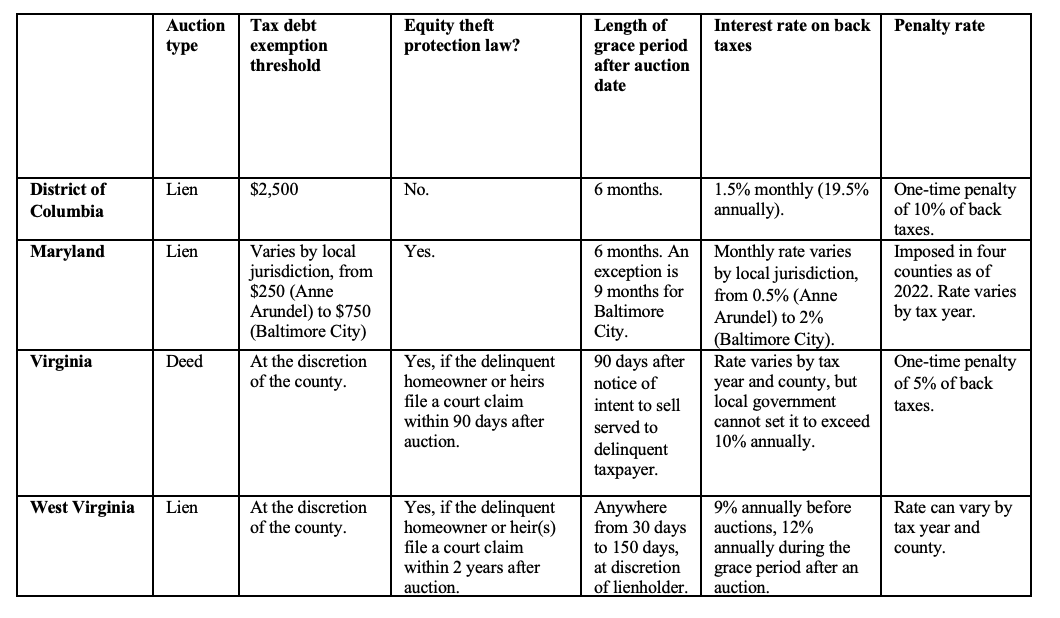

Figure 2: Tax Auction Policy Differences across the Washington, D.C. Metro Area

Sources: District of Columbia Municipal Regulations and District of Columbia Register: §§ 9-317, -318, -335, -337 [link]; District of Columbia Code §§ 47-1382.01, -1332(c)(2) [link]; Md. Code Ann. §§ 14-820, -833, -836, -852 [link]; 2022 Annual Maryland Tax Sale Report [link]; Va. Code Ann. §§ 58.1-3915, -3916, -3918, 3965, -3967, -3975, [link]; Wv. Code Ann §§ 11A-1-3(a), 3-10, -3-52, 3-54, -3-56(a)(1), -4-3, [link].

Figure 2 summarizes how key aspects of tax auction policy differ across the District of Columbia and neighboring states. DC, Maryland, and West Virginia hold tax lien sales, while Virginia holds tax deed sales. Of the four tax codes, only DC’s does not provide any equity theft protections for delinquent homeowners. All four tax codes allow for a grace period after the auction during which the debt can be repaid to preserve ownership. The interest rate and penalties charged on back tax amounts can vary by tax year and county within states, and annual interest rates tend to be very high – often vastly exceeding average stock market returns, or the 6 percent annual rate set by the IRS for Federal income tax liens.7

Bidders at an Auction

Buyers at a tax lien auction can be individuals, non-profit entities, retail investors, or large institutions. Individuals often purchase tax liens on homes in neighborhoods that are not undergoing gentrification. Meanwhile, retail investors and institutions —who have become more active in the tax lien market since the 2008 financial crisis brought on a wave of foreclosures —often purchase tax liens on homes in neighborhoods that are currently gentrifying.8 A gentrifying neighborhood is one that, as high-income individuals move in, becomes unaffordable to potential lower-income, and often non-white, homebuyers or renters.

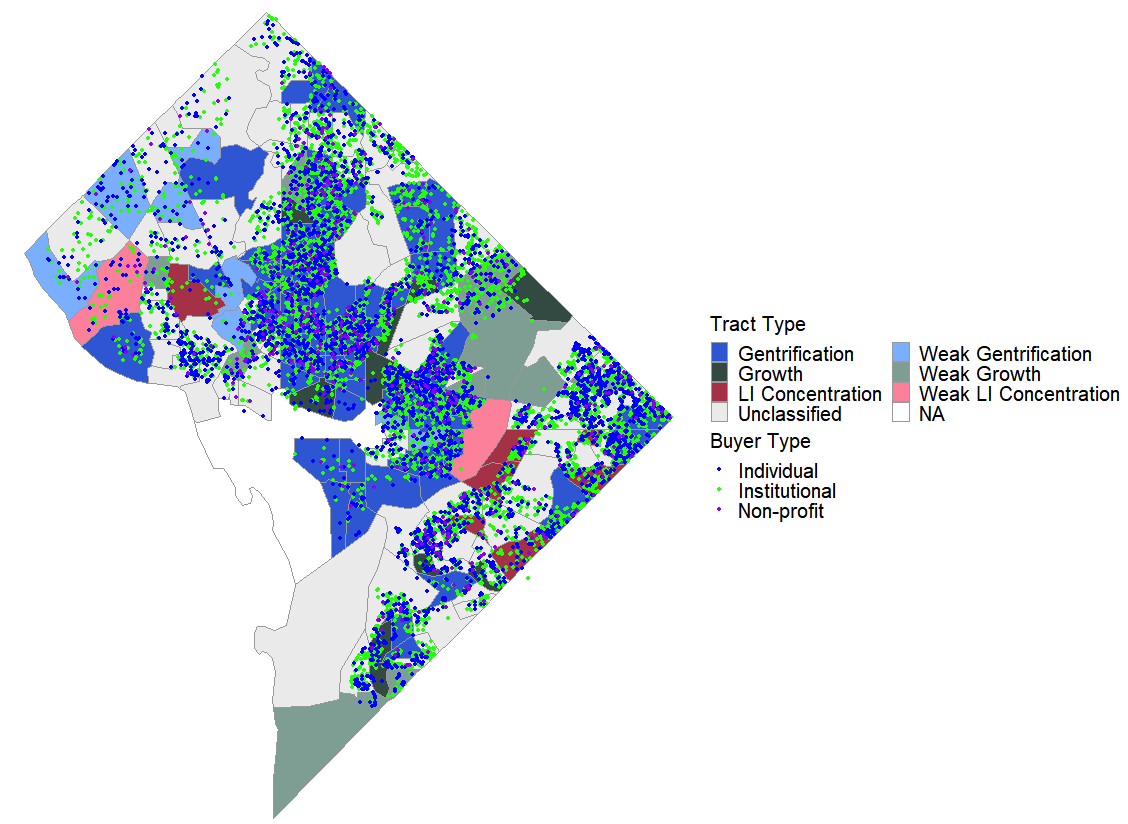

Figure 3: Institutional Investors Predominantly Buy Tax Liens for Properties Located in Gentrifying Washington, D.C. Census Tracts

Source: The map displays Census tracts for D.C. color-coded by population growth patterns between 2005 and 2019 using Decennial Census and American Community Survey (ACS) data from IPUMS. Gentrifying tracts are those experiencing high-income population growth but low-income population decline. Growth tracts where both high-income and low-income population are expanding. Low-income concentration tracts feature low-income population growth and high-income population decline. Unclassified tracts are those with little to no population growth. Each point on the figure corresponds to the location of a tax lien sale in D.C. between 2005 and 2019. For full details on the definition of gentrifying and non-gentrifying Census tracts and classification of investors, see: LaPoint, Cameron (2023): “Property Tax Sales, Private Capital, and Gentrification in the U.S.,” SSRN Working Paper, No. 4219360: [link].

Figure 3 maps the location of D.C. tax lien sales occurring between 2005 and 2019. The figure shows when the buyer is an individual (blue points), an institution (green points), or a non-profit organization (purple points). A total of 18,419 tax liens were sold and attached to 14,094 unique properties during this time. 48 percent of D.C. Census tracts have undergone gentrification over this period. Since the financial crisis, 47 percent of tax lien sales have occurred in gentrifying tracts.9 Non-individual, for-profit investors have accounted for 76 percent of liens sold on properties in gentrifying neighborhoods.

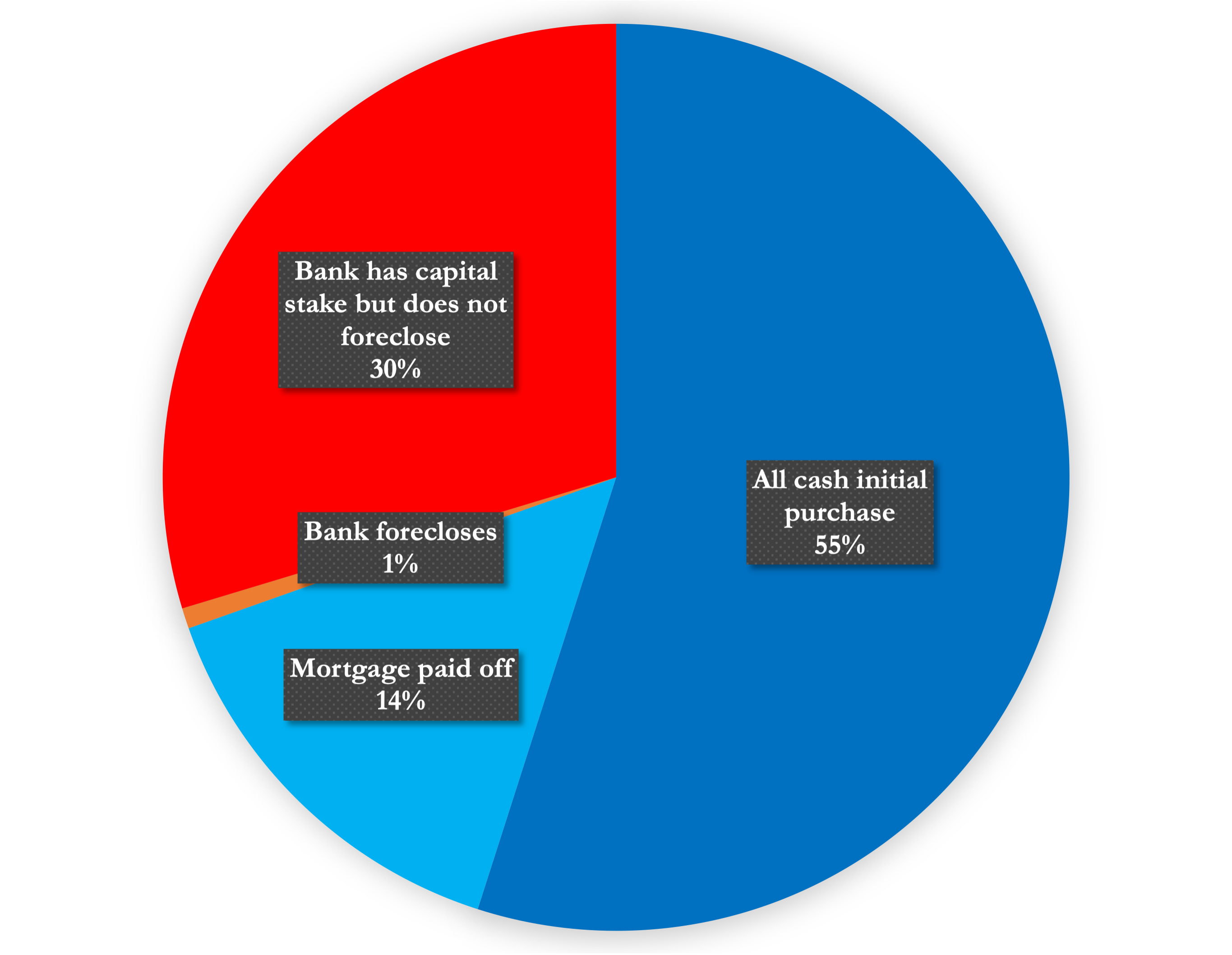

Figure 4: Majority of Homeowners with Properties Auctioned off at Tax Sale Have Either Fully Paid Off Their Mortgage or Initially Purchased the House Using Only Cash

SSource: The pie chart classifies tax sale cases into four categories based on the behavior and existence of mortgage lenders tied to the property being sold at tax lien auction in D.C. “All cash initial purchase” refers to properties for which the homeowner originally bought the house without taking out a mortgage. “Mortgage paid off” refers to properties where the homeowner originally bought the house with a mortgage, but completely paid off the loan balance by the time the auction took place. “Bank forecloses” refers to cases where there is a lender who issued a mortgage for the property, and that lender forecloses on the property within the six-month redemption period after the tax sale. Finally, when the “bank has a capital stake but does not foreclose,” this refers to cases in which the bank does not foreclose despite having issued a loan with an outstanding balance greater than the outstanding tax debt plus the $3,200 limit in legal fees set by Fannie Mae for judicial foreclosures in D.C. [link]. For full details see: LaPoint, Cameron (2023): “Property Tax Sales, Private Capital, and Gentrification in the U.S.,” SSRN Working Paper, No. 4219360: [link].

What role do mortgage lenders play in the tax sale system? It turns out that tax lien sales and mortgage foreclosures are distinct events. Figure 4 shows that the two events rarely coincide. A substantial majority of people who are affected by tax lien sales have paid off their home mortgage (14 percent of cases) or originally bought their house using only cash (55 percent of cases). Mortgage foreclosures overlap with tax lien sales only in 1 percent of cases. Remember that a mortgage foreclosure occurs when a bank seizes one’s house because one has stopped making mortgage payments. In the remaining 30 percent of cases, the bank has a capital stake, or a non-trivial amount of money tied up in the loan for the delinquent home. But the bank does not move to foreclose. This latter case can occur either because the homeowner promptly pays off their debt after the auction, or the lender pays off the tax debt and then works with the homeowner to restructure their mortgage repayment schedule.

LaPoint, Cameron (2023): “Property Tax Sales, Private Capital, and Gentrification in the U.S.,” SSRN Working Paper, No. 4219360: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4219360.↩︎

In D.C., the surplus revenues are eventually rebated back to the investor – but not the homeowner—if the debt is either paid off by the delinquent homeowner, or the investor forecloses. See District of Columbia Municipal Regulations and District of Columbia Register: §§ 9-316 [link]. However, in many deed states (e.g., Massachusetts), the profits generated by the gap between the final auction bid and the underlying tax debt are retained by the local tax authority. See Clifford, Ralph D., “Massachusetts Has a Problem: The Unconstitutionality of the Tax Deed,” U Mass Law Review, 13(2): 274-305 [link].↩︎

Deerson, David, Joshua Polk, & Christina Martin (2023): “Home Equity Theft: Tax Foreclosure Laws in 50 States and the District of Columbia,” Pacific Legal Foundation report: [link] (accessed March 3, 2023).↩︎

District of Columbia, Office of Tax and Revenue: “District of Columbia 2022 Real Property Tax Sale Informational Guide,” [link] (accessed March 3, 2023). ↩︎

LaPoint, Cameron (2023): “Property Tax Sales, Private Capital, and Gentrification in the U.S.,” SSRN Working Paper, No. 4219360: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4219360. ↩︎

D.C. Office of Tax and Revenue, “Real Property Tax Rates and Billing FAQs” : https://otr.cfo.dc.gov/page/real-property-tax-rates-and-billing-faqs (accessed March 5, 2023).↩︎

IRC §6321.↩︎

LaPoint, Cameron (2023): “Property Tax Sales, Private Capital, and Gentrification in the U.S.,” SSRN Working Paper, No. 4219360: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4219360.↩︎

44 percent of tracts can be classified as gentrifying while an additional 4 percent of tracts were “weakly gentrifying,” where low-income population crowd-out was slightly less severe. Adding the two types of tracts together results in a total of 48 percent of all tracts on the map experiencing some gentrification.↩︎